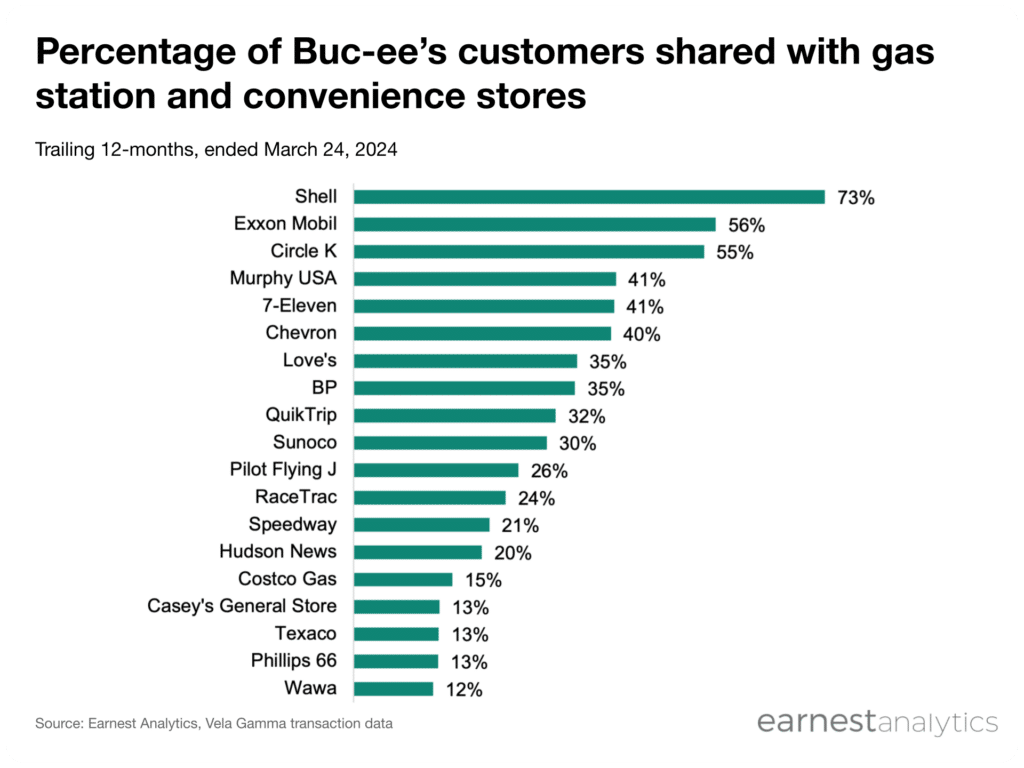

Buc-ee’s expansion could have highest impact on Shell, Exxon Mobil, and Circle K

Access chart data in Dash.

Around 73% of Buc-ee’s customers also shopped at Shell in the trailing 12 months ended March 24, 2024 according to Earnest credit card data. It is just one sign that the gas station chain is making inroads with incumbent gas station brands. The jumbo-sized Buc-ee’s locations attract fans with their branded merchandise, supermarket-like food offerings, and clean facilities. The Texas-based gas station plans to expand further west and south.

Across major gas station chains, Buc-ee’s customers’ other most preferred gas stations are Exxon Mobil (56%), Circle K (55%), Murphy USA (41%), 7-Eleven (41%) and Chevron (40%). Around a third or fewer have also shopped at Love’s (35%), BP (35%), and QuikTrip (32%). Given its presence in the South and growing presence in the West, there is still relatively little overlap with two famous gas chains with cult followings–Wawa (12%) in the Northeast and Casey’s General Store (13%) in the Midwest.

These major legacy competitors still have one big advantage: Buc-ee’s large footprint means it doesn’t fit everywhere. That means for now there are fewer Buc-ee’s, a disadvantage when competing for everyday fill up trips. Shell’s larger network for instance means customers return twice as often as Buc-ee’s (access data in Dash). Brand overlap and customer lifetime value analysis will be key to tracking if Buc-ee’s can succeed in closing the loyalty gap with incumbent gas station chains.

Track Gas Station spending for free